Best Tools For Dividend Tracking

Dividends, chosen wisely, can be an awesome investment strategy, particularly for those looking for an income investing strategy. But how do you manage all of these different assets that produce different yields on different schedules? The answer, of course, is to leverage this thing you might have heard about; it's called technology. There are a multitude of dividend tracking tools available, including a brand new one that we at Marketplays just launched.

This guide explores the best tools to track dividends, how to use them based on your investing style, and what smart investors do to turn dividend data into long-term growth.

Why does tracking dividends matter for long-term investors?

Dividends are cash (or stock) payments companies make to shareholders, a share of the profits paid for simply owning part of the business. Fundamentally, dividends are supposed to attract long-term investors, who want some sort of yield for locking up their money for a substantial period of time. The practice dates back to the 1600s, but today it's still a cornerstone of modern investing. As dividends produce recurring income, many see it as a staple of what's deemed an "income investing" portfolio. Many of the world’s most stable blue-chip companies, like Johnson & Johnson and Microsoft, pay consistent dividends. For long-term investors, dividends offer something powerful: income without selling assets. You’re earning while holding, and potentially compounding that income over time.

What makes a great dividend tracking tool?

Real-time data, DRIP insights, tax tracking

The best dividend tracking tools go beyond the simple listing of your past payments. The good ones should give you real-time insights in terms of your portfolio is performing now, and how it could perform in the future.

Introducing Dividend Strategy Builder by MarketPlays

We've seen such a demand recently...

We've seen such a demand recently for dividend-yielding stocks and information related to everything, so we built our own tool! We've been working around the clock to get it out, but we think our users and the general public will find it indispensable. Instead of a basic payout calendar, it works as a strategy engine that helps investors put together portfolios that balance steady income with growth potential. So what does this look like, and why is ours different?

Highlights:- Smarter rankings that weigh yield, payout history, growth trends, and market momentum

- One-click execution, so strategies can be invested in without jumping between brokerages

- Real-time income tracking with estimated annual dividend income updated as portfolios shift

With everything in one place, the Dividend Strategy Builder saves investors from endless spreadsheets and research. It offers a faster, cleaner way to manage dividends while keeping the bigger picture of long-term income front and center.

Top dividend tracking tools

As mentioned above, our new dividend tracking tool ticks all the boxes...

As mentioned above, our new dividend tracking tool ticks all the boxes we feel are imperative for an all-encompassing dividend tracking tool. That being said, there's no shortage of dividend tools out there, but not all are the same. Some are built for number crunchers, and others make more sense for visual learners. We’ve rounded up the most popular tools used by real investors in the MarketPlays community and broken them down by style, strengths, and who they’re best suited for.

🛠️ 1. Seeking Alpha

Best for: Research-focused investors who want crowd-sourced analysis plus dividend health metrics.

- Tracks yield, dividend payout history, and forward income

- Dividend safety grades and alerts for changes

- Community notes reveal red flags early

- Premium unlocks full scorecards and earnings data

🌍 2. Sharesight

Best for: Global investors and tax-conscious savers juggling multiple accounts.

- Tracks dividends, splits, and reinvestments automatically

- Breaks out capital gains vs income for tax reporting

- Exports clean tax reports, including for UK and AUS investors

- Google Sheets integration is available

🇬🇧 3. DividendMax

Best for: UK investors or anyone who wants accurate dividend calendars.

- Precise forecasts for upcoming payments

- Weekly/monthly income breakdown

- Visual calendar helps smooth income planning

- Simple UI for long-term visibility

🛡️ 4. Simply Safe Dividends

Best for: Conservative investors looking to avoid dividend cuts and maintain reliability.

- Every stock gets a dividend safety score

- Tracks payout ratios and free cash flow coverage

- Identifies red flags early

- Streamlined dashboard with high clarity

📊 5. Portfolio Visualizer

Best for: Quantitative investors who want to model outcomes and backtest dividend strategies.

- Simulates DRIP returns and asset performance

- Backtest custom portfolios with real dividend data

- Manual entry only, no syncing

- Ideal for strategy refinement and stress testing

📚 6. Morningstar Dividend Investor

Best for: Research-first investors who value expert picks and curated dividend insights.

- Model portfolios curated by analysts

- Research-rich dividend commentary

- Stock picks with fundamental rationale

- Strong fit for strategic, fundamentals-driven investors

🧠 7. Google Sheets + APIs

Best for: DIY investors and data lovers who want total control.

- Pulls real-time data via API scripts (e.g. GoogleFinance or IEX)

- Fully customizable dashboards and yield charts

- Ideal for automation or layered strategies

- High learning curve, but unmatched flexibility

Dividend tracking tools: Portfolio sync vs manual entry

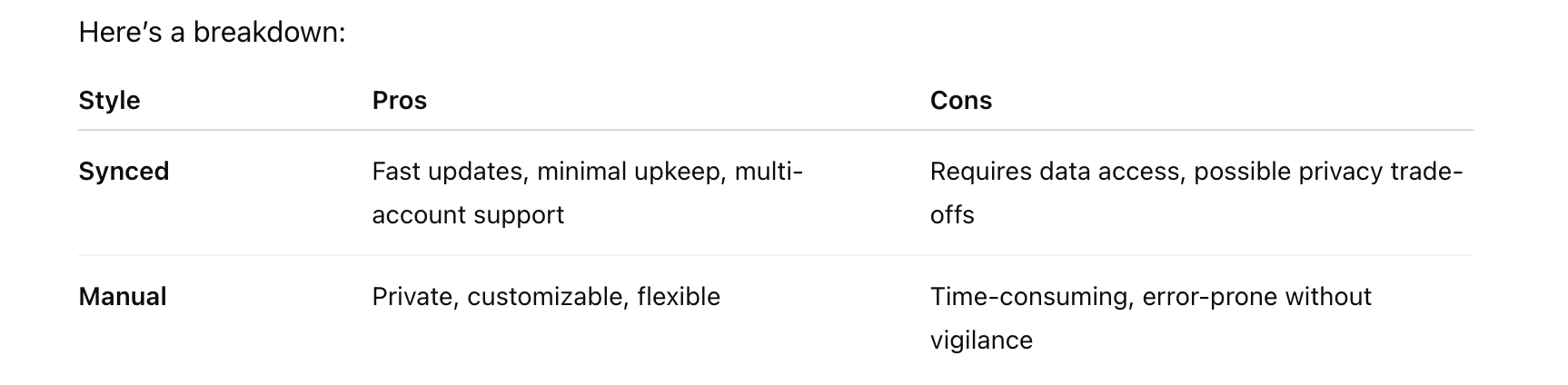

Modern tracking tools fall into two camps...

Modern tracking tools fall into two camps: synced and manual. At MarketPlays, we currently offer syncing options for users of both Alpaca and Webull.

- Syncing allows you to connect directly with your brokerage accounts. Once connected, your portfolio data, tickers, quantities, trades, and dividends flow in automatically. This saves time and eliminates manual errors.

- Manual tools require you to input holdings yourself. While this takes more effort, it gives you full control and can be more secure for those concerned with privacy.

How do different investors track dividends?

The income maximalist

Income-focused investors aim to cover living expenses through dividends, favoring high-yield stocks, monthly payers, and stable ETFs. To manage risk, they rely on tools that offer dividend safety scores, real-time income projections, ex-dividend alerts, and tax reporting.

Tools: Dividend Strategy Builder, DividendMax, Simply Safe Dividends, Sharesight

The reinvestor

Reinvestors focus on long-term growth, using DRIPs to build compound returns. They care most about dividend growth rates, yield-on-cost, and reinvestment visualization. Many use tools to track allocation changes and performance over time.

Tools: Seeking Alpha Premium, Dividend Strategy Builder, Portfolio Visualizer, Google Sheets

The tax optimizer

These investors prioritize after-tax returns like Warren Buffett. They use trackers that break down qualified vs non-qualified dividends, estimate tax exposure, and handle foreign withholding.

Tools: Sharesight, Morningstar Dividend Investor, Dividend Strategy Builder, custom spreadsheets

The blender strategist

Strategists blend growth and income across sectors, ETFs, and stocks. They use trackers to analyze consistent payers, flag weak sectors, and align with peer trends.

Tools: Seeking Alpha, SCHD/VYM tools, Google Sheets with community insights, Dividend Strategy Builder

Trending dividend stocks across investor types

Across all profiles, some names pop up again and again. In 2025, a few dividend plays are earning broad attention:

- Altria Group (MO): Known for a high yield, but debated long-term outlook

- Chevron (CVX): A reliable energy-sector dividend payer with long-term credibility

- Johnson & Johnson (JNJ): A Dividend King offering growth and stability

- Vanguard High Dividend Yield ETF (VYM) and Schwab U.S. Dividend Equity ETF (SCHD): Go-to baskets for those who want diversified dividend income with lower risk

Real-world dividend strategy scenarios

From long-term reinvestors to income-focused retirees, here's how different dividend investors structure their portfolios, set income goals, and track performance over time.

Scenario 1: Young investor building passive income

Sofia is a 27-year-old investor focused on growing her future income, and her goal is to reach $500/month in dividend payouts by age 40. She holds broad-market and dividend-focused ETFs like VTI and SCHD in a Roth IRA and reinvests all dividends automatically. Sofia uses a mix of Google Sheets and Seeking Alpha to track her progress manually and sets alerts to buy on market dips. She currently earns around $60/month in dividends and plans to scale up through consistent contributions and compound growth over the next 13 years.

Scenario 2: FIRE-focused couple reinvesting dividends

Jake and Priya, aged 35 and 36, are working toward financial independence by 2035. Priya is a FIRE fan and wants to see if she can produce more by age 50. Their goal is to replace 70% of their $5,000 monthly expenses using dividends, about $3,500/month. They invest in growth-oriented dividend stocks and ETFs like VIG and NOBL, using Sharesight to track portfolio income and reinvestments across both taxable and IRA accounts. With a long-term view and disciplined DRIP participation, they currently generate around $950/month in dividends and reinvest it all.

Scenario 3: Retiree using dividends for monthly cash flow

Carlos is a 66-year-old retiree who relies on dividends for stable income. His current goal is to generate about $3,000/month to support living expenses, which he nearly meets through consistent payers in sectors like utilities and consumer staples. Carlos uses DividendMax to plan and visualize his income, withdrawing 3.5% annually without touching principal. Unlike younger investors, he does not reinvest dividends but instead uses them directly as monthly cash flow.

What do the experts say? We spoke to Asher Rogovy, the chief investment officer of Maginfina ( an SEC-registered investment Adviser (RIA) firm), about his dividend strategy.

"Investors also look for non-decreasing dividends. When a company reduces its dividend unexpectedly, the stock price usually falls. For whatever reason, NVDIA began paying a small dividend over a decade ago. Evidently, they were still able to fuel their growth without needing to reduce it. Looking forward, I would expect that dividend to increase. However, it still might take many years for the rate to break even 1% annually."

Pro tips: Getting the most out of your tracking tools

| Tip | Why It Matters |

|---|---|

| Use alerts to time your reinvestment | Set notifications for ex-dividend dates or payouts to reinvest or buy strategically. |

| Track ex-dividend dates and payment schedules | Avoid buying just before a stock drops post-payout; stagger dates for steady income. |

| Review income trends quarterly, not yearly | Spot slowing growth or dividend cuts early so you can adjust your portfolio sooner. |

FAQ

What’s the difference between qualified and non-qualified dividends?

Qualified dividends are subject to lower tax rates (0–20%) because they meet specific holding-period and issuer requirements, while non-qualified (ordinary) dividends are taxed at your regular income rate. To qualify, you must hold the stock for at least 60 days around the ex-dividend date, and the dividend must come from a U.S. corporation or a qualifying foreign entity. Understanding this helps you choose tax-efficient assets and track dividends by qualification status.

How does the ex-dividend date affect stock price and income planning?

The ex-dividend date is the cutoff for receiving the next dividend. Stocks typically drop by approximately the dividend amount on that date, so buying too close can lead to a short-term price dip with little income benefit. Timing purchases and dividend calendars strategically can avoid this dip and help smooth your cash flow.

Are stock dividends as useful as cash dividends?

Stock dividends pay in additional shares rather than cash, and while they don’t impact your current income, they still trigger a tax liability based on the market value of the shares received. Many investors prefer cash for immediate flexibility and visibility in tracking payouts and reinvestment. However, stock dividends can compound your position—just be sure your tracking tool can distinguish between cash and stock distributions.

Comments (0)

No comments yet

Be the first to share your thoughts!